Additional Regions Qualify for Livestock Tax Deferral

February 3, 2026

In October 2025, BFO submitted a request to Agriculture and Agri-Food Canada (AAFC) to expand the eligible drought zones eligible for the Livestock Tax Deferral (LTD) provision to better reflect drought conditions experienced by Ontario producers in 2025. We are pleased to share that AAFC has now updated the 2025 list of prescribed regions eligible for the LTD provision, effective for the 2025 taxation year.

What is the Livestock Tax Deferral Provision?

The Livestock Tax Deferral provision is a federal tax measure that allows farmers in prescribed drought, excess moisture or flood-affected regions to defer a portion of their income from the sale of breeding livestock to the following tax year. This can provide meaningful tax relief for producers forced to liquidate breeding stock due to extreme weather conditions.

Key points of the program:

The provision applies when a breeding herd has been reduced due to adverse weather conditions such as drought, excess moisture or flooding.

To qualify:

- The farm must be located in a prescribed region as identified by AAFC.

- The breeding herd must be reduced by at least 15%.

- Deferral amounts:

- If the herd reduction is 15%–29.9%, up to 30% of income from net sales may be deferred.

- If the reduction is 30% or more, up to 90% of income may be deferred.

- Once a region is prescribed, it is considered eligible for the taxation year—even if conditions change later in the season.

AAFC continues to monitor weather, climate and forage data through the growing season and may add regions that meet eligibility criteria. Adjacent buffer zones are also now included to support producers on the periphery of impacted areas.

Updated 2025 Prescribed Regions in Ontario

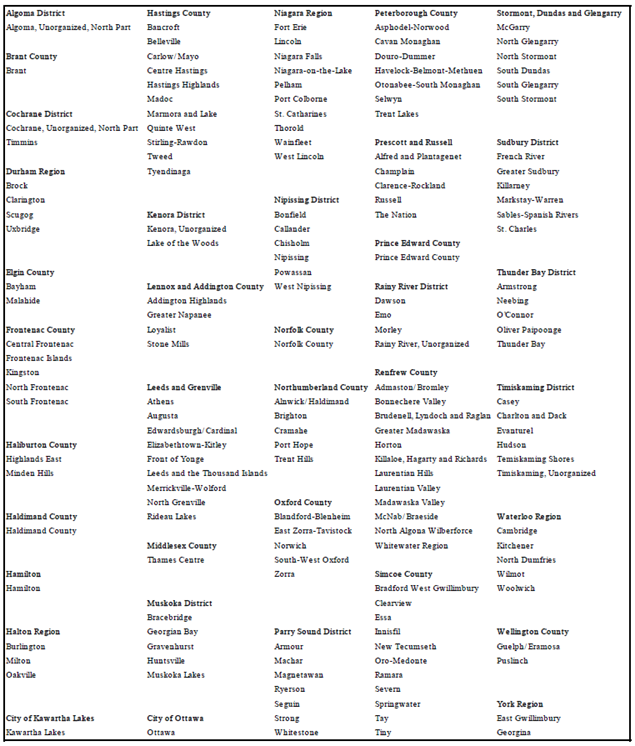

The full list of prescribed regions now includes the Ontario census subdivisions (as defined by Statistics Canada) found here. These areas are eligible for the Livestock Tax Deferral for the 2025 taxation year. For ease, BFO has grouped the subdivision list by county and district.

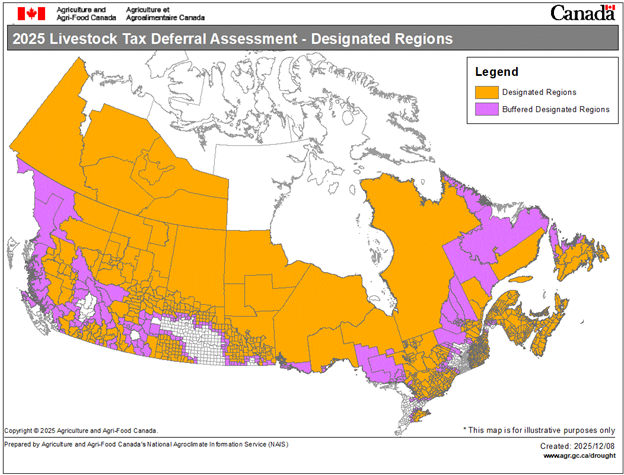

Ontario Designated Regions (2025)

Many of these have a buffered designation (shown on the map in purple), meaning adjacent areas impacted by conditions are included.

Need Assistance?

If you have questions about the Livestock Tax Deferral provision, eligibility criteria, or how to apply this to your tax planning, please contact:

Thomas Brandstetter, Manager of Policy and Issues

519.824.0334 ext. 236

thomas@ontariobeef.com

We encourage producers in affected regions to review this list and consult with their accountants or tax advisors to determine how the LTD provision can support their 2025 tax filing.

Skip to main content

Skip to main content